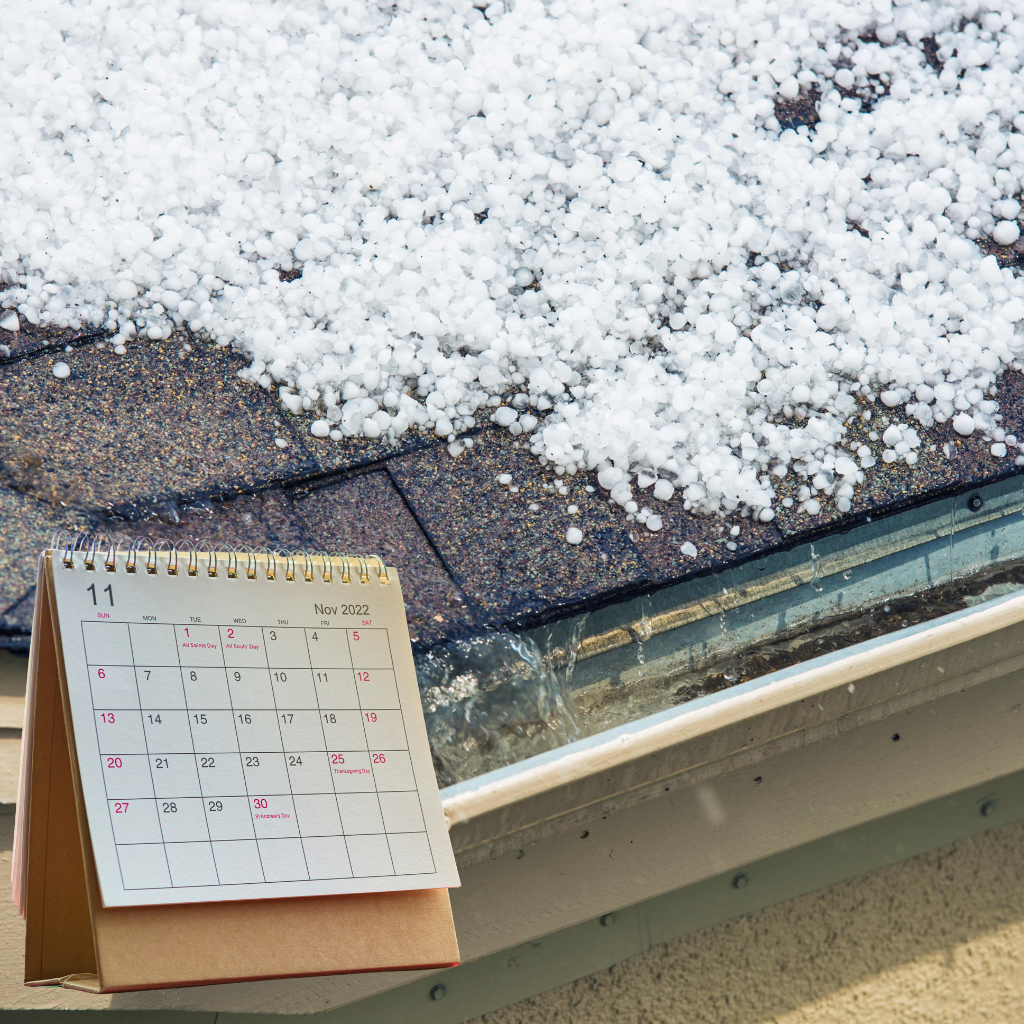

When a severe storm passes through your neighborhood, one of the first things roofing professionals and insurance companies look for is something called the “Hail Date.” This date marks the specific day a hailstorm impacted your property and potentially caused damage to your roof.

Knowing your Hail Date is critical for filing insurance claims, scheduling timely roof inspections, and protecting your home’s long-term structural integrity. Homeowners in Asheville, NC and across the country may be unaware of how essential this date is—until it’s too late.

Key Takeaways

💡A Hail Date is the recorded date when hail impacted your property.

💡Insurance companies require hail date verification from third-party weather tracking services.

💡You usually have 1 year to file a claim after a hail date, depending on your state and insurer.

💡Prompt roof inspection after a hail event can prevent larger, more expensive issues like leaks or structural rot.

What Is a Hail Date, Exactly?

A Hail Date refers to the exact day a hailstorm occurred in your area that may have caused damage to your roof or property. Insurance companies rely on this date as proof of damage eligibility for storm-related claims.

Insurance adjusters will often cross-reference your hail claim with data from NOAA’s National Weather Service (NWS) or third-party weather tracking companies like CoreLogic, HailTrace, or Weather Fusion.

🌀 Why It Matters

Without a documented hail date:

- Your insurance claim may be denied.

- Your roof repairs might not be covered.

- You risk missing your claim filing window.

How to Find Out If Your Home Has a Hail Date

If you’re unsure whether your home has been impacted by a hailstorm, there are several ways to determine your hail date:

1. Use NOAA’s Storm Events Database

Visit the official NOAA Storm Events Database. Search by your county or ZIP code to find storm dates and types (hail, wind, etc.).

2. Request a Free Hail Report from a Roofing Contractor

Reputable companies like Litespeed Construction offer free hail inspection reports and access to professional weather tracking software to determine your home’s hail exposure.

3. Look for Local News Reports or Emergency Alerts

Hailstorms usually make local headlines, especially in areas like Asheville, where weather can be unpredictable. Check local news archives for storm dates.

How to Find Out If Your Home Has a Hail Date

Not all hail is visible from the ground. Damage may appear as:

- Bruised or cracked shingles

- Granule loss

- Exposed roofing mat

- Dents on vents, flashing, or gutters

- Damaged skylights or HVAC components

How to Find Out If Your Home Has a Hail Date

| Hail Size (Diameter) | Comparison | Potential Roof Damage |

|---|---|---|

| 0.25 inches | Pea-sized | Minimal, mostly cosmetic |

| 0.50 inches | Marble-sized | Minor granule loss, gutter dings |

| 1 inch | Quarter-sized | Shingle bruising, cracked tiles |

| 1.5 inches | Ping-pong ball | Broken shingles, flashing damage |

| 2+ inches | Egg or golf ball | Severe structural damage, leaks |

Why Acting Quickly After a Hail Date Is Crucial

In North Carolina, homeowners typically have up to 1 year from the date of the hailstorm to file an insurance claim, though this can vary by policy. Some insurers allow up to 2 years, but delays can lead to:

- Claim denial due to “pre-existing damage”

- Evidence of damage eroding over time

- Increased out-of-pocket repair costs

📣 Tip from Litespeed Construction: Get your roof inspected within 48–72 hours of a hailstorm to maximize your insurance claim potential.

The Insurance Process: What Role Does a Hail Date Play?

Here’s how the hail date fits into your roofing insurance claim:

Step-by-Step:

- Storm Hits – Hail falls on your property.

- Hail Date Logged – Recorded by NOAA or third-party services.

- Damage Inspection – Contractor inspects your roof.

- Claim Filed with Insurer – Must reference hail date.

- Adjuster Visit – Insurer verifies damage and hail date.

- Payout or Denial – Based on verified damage and policy limits.

Asheville, NC: Why Hail Dates Matter More Here

Asheville and surrounding Buncombe County experience several hail events per year. According to NOAA data:

🧊 Between 2010 and 2024, Buncombe County reported 126 hail events, with stones up to 1.75 inches in diameter.

Due to the mountainous microclimates, storms can hit one neighborhood and miss another entirely. That’s why having an exact hail date tied to your specific property is critical in Asheville.

Why Choose Litespeed Construction for Hail Damage Repairs

Litespeed Construction is a licensed, insured, and locally trusted roofing company with decades of experience in storm damage assessment.

✅ What Sets Us Apart:

- Free hail damage inspections

- Drone-assisted roof assessments

- Fast claim documentation and support

- Transparent, honest quotes

- Deep understanding of Asheville’s roofing codes

Pros and Cons of Tracking Hail Dates

| Pros | Cons |

|---|---|

| Helps secure insurance claim payouts | Requires quick action post-storm |

| Prevents long-term structural issues | May require proof from 3rd party sources |

| Provides peace of mind for homeowners | Inspections might show no visible damage |

| Makes roofers and insurers more accountable | Hail dates can be contested by insurance |

Web Ratings for Hail Date Reporting Tools

| Tool | Average Rating | Best Feature |

|---|---|---|

| NOAA Storm Database | 4.8 / 5 | Official government data source |

| HailTrace | 4.7 / 5 | Property-specific tracking |

| CoreLogic Hail Maps | 4.6 / 5 | High-res radar-based data |

| Weather Fusion | 4.4 / 5 | Nationwide hail event coverage |

| Litespeed Reports | 5.0 / 5 | Free local hail report + expert analysis |

FAQs About Hail Dates

It’s the official date a hailstorm occurred in your area, used for insurance verification.

Use NOAA, third-party tools like HailTrace, or contact a roofing company like Litespeed.

Yes, insurers typically require date confirmation to validate your claim.

Usually within 1–2 years, but check your insurance policy.

Sometimes, but not always. A professional inspection is best.

Hidden damage may still exist—have it inspected to be sure.

Not necessarily; a storm may involve wind or rain without hail.

Not always; hail is considered an "act of God" in most policies.

If you're past your claim window, coverage may be denied.

Litespeed Construction offers free hail inspections in Asheville and nearby areas.